Uncategorized

Home Sales Down: Market Correction?

Recent headlines have pointed to a decline in pending home sales, raising questions about the possibility of a market correction. However, before we jump to conclusions, it’s crucial to understand the dynamics at play. In this blog post, we’ll delve into the current state of pending home sales and whether it signals an imminent market correction in the real estate industry.

The Relationship Between Pending Home Sales and Market Correction

It’s a common misconception that a decrease in pending home sales automatically translates to lower property prices. In reality, the relationship between these two factors is more complex. To shed light on this issue, let’s examine some key points.

1. Inventory is the Key

The real estate market operates on the principles of supply and demand. For property prices to decrease significantly, there needs to be a surplus of available homes for sale. A dip in pending home sales alone does not necessarily equate to lower prices. To see a significant correction, we’d require a substantial increase in housing inventory, which, at present, isn’t happening in many areas.

2. Buyer Demand vs. Supply

One crucial factor to consider is the balance between buyer demand and housing supply. While buyer demand may experience fluctuations, it is still outweighing the available supply in many regions. This persistent demand, coupled with limited inventory, continues to support an increase in home prices.

Analyzing Regional Trends

No one can argue with data, so let’s examine regional trends. Despite the decline in pending home sales, we see that median home prices have followed a different trajectory:

1. The Northeast: Pending home sales have decreased by 22.6% compared to last year, but median sales prices have increased by 5.8%.

2. The Midwest: Home sales are down by 16.4%, yet median prices have increased by 6.8%.

3. The South: Sales have fallen by 12.4%, with a 3.2% increase in median prices.

4. The West: Sales have dropped by 2.6%, while median prices have still increased by 1%.

A National Perspective

While discussing real estate trends on a national scale isn’t the norm for me, it’s important to address misleading headlines and rumors. The current state of pending home sales does not automatically indicate an impending market correction.

Conclusion

In conclusion, a decline in pending home sales does not signify an market correction or crash in the real estate industry. As real estate professionals, it’s essential to stay informed and base our insights on comprehensive data to provide accurate guidance to buyers and sellers. So, while headlines may raise concerns, it is always best to reach out to a trusted local realtor for the more accurate knowledge and advice.

Mortgage Loan Types: Your Comprehensive Guide to homebuying

Achieving the dream of homeownership is a significant milestone in life. However, navigating the complex world of mortgages and the various types of loans available can be overwhelming for first-time buyers and seasoned homeowners alike. To help you make an informed decision, we’re here to shed light on the main types of mortgages that can empower you on your homeownership journey.

1. Conventional, Fixed Rate Mortgage: Steady as a Rock 🔒

The fixed-rate mortgage is the bedrock of stability when it comes to homeownership. It’s one of the primary types of loans you’ll encounter. With this mortgage, your interest rate is locked in at the beginning of the loan and remains constant throughout the entire term. This means your monthly payments remain predictable, making budgeting a breeze.

2. Adjustable Rate Mortgage (ARM): Flexibility is Key (🔄)

For those who value flexibility, the Adjustable Rate Mortgage (ARM) is another vital category among types of loans for purchasing a home. Unlike its fixed-rate counterpart, an ARM starts with a stable interest rate for an initial period, often a few years. After this initial phase, the interest rate can fluctuate based on market conditions. While this can lead to lower initial payments, it’s essential to be prepared for potential rate adjustments down the road.

3. FHA Loan: First-Time Buyers, Listen Up! (🏠)

For first-time homebuyers, the journey can be particularly daunting, but the FHA loan is designed with you in mind within the realm of different types of loans for home purchase. Backed by the government, an FHA loan offers lower down payment requirements and more forgiving credit score criteria. It’s an excellent choice for those eager to step into homeownership without a hefty down payment burden.

4. VA Loan: Honoring Our Heroes (🇺🇸)

To our service members and veterans, your dedication and service deserve recognition. The VA loan is a special mortgage within the world of types of loans, designed to honor your commitment. What sets it apart? No money down is required. Yes, you read that correctly – zero down payment. Additionally, VA loans often come with competitive interest rates making homeownership more accessible to those who have served our country.

Conclusion: Your Path to Homeownership Begins Here

As you embark on your homeownership journey, understanding the different types of mortgages is the first step towards making the right choice. Working with a trusted lender early in the process will help you understand which loan will work best for your financial and personal situation.

Now that you’ve explored these key mortgage loan types, it’s time to take action. Hit this link to get connected with a reputable lender. Remember, your dream home is within reach, and finding the right mortgage for you can make it a reality. Happy house hunting! 🏡🗝️

Sellers, Don’t Miss Out on Thousands! The Importance of Your Realtor Staying Updated on Appraisal Changes

Selling your home in Annapolis? Don’t leave thousands on the table! Your Realtor’s awareness of appraisal changes is your ticket to maximizing profits in this dynamic market. Stay tuned to discover why being up-to-date matters.

Understanding the Role of an Appraiser

In the dynamic realm of real estate, one crucial but often misunderstood player is the appraiser. They are the individuals responsible for determining the value of your property. Their assessment can significantly impact your real estate deal, putting money either in your pocket or taking it out.

Our morning was spent in the company of an appraiser, shedding light on their vital role in the industry. Here’s a glimpse of what we learned and how it can benefit you as a homeowner or prospective buyer.

Adapting to Market Shifts

The Annapolis real estate market, like many others, is continually evolving. In today’s fast-paced world, staying ahead of the curve is essential for success. An appraiser’s knowledge and expertise can be the difference between a great deal and a missed opportunity.

One of the first insights we gained during our morning session was how appraisers are adapting to the ever-changing landscape. This is particularly crucial in markets like Annapolis, where there may not be an abundance of recent home sales to compare to.

Traditionally, appraisers used a 1-mile radius and a 3-6 month time frame when assessing comparable properties. However, things have changed. In the current market, they’re broadening their horizons, both in terms of location and timeframe.

Looking Beyond the Numbers

Picture this: You’re browsing online, and you spot a house in your neighborhood that sold for $500,000. Does that mean your own property is also valued around that range? Not necessarily.

In today’s Annapolis real estate market, appraisers are venturing beyond the confines of the old rules. They are exploring sales data from greater distances and considering transactions that occurred months ago. This shift allows them to provide a more accurate picture of your property’s true value.

The Importance of Realtor Knowledge

So, what’s the key takeaway here? The knowledge and expertise of your Annapolis Realtor matter more than you might think. In a market as fluid as this one, being well-informed can save you thousands of dollars and help you make sound real estate decisions.

Whether you’re gearing up to sell your Annapolis home or you’re simply curious about its current value, our team is here to help. Just drop a 🏡 emoji in the comments below, and we’ll provide you with a FREE home value assessment.

Conclusion

In the world of Annapolis real estate, understanding the nuances of appraisals and staying informed about market shifts can be the key to your success. As your trusted Annapolis Realtor, we’re committed to providing you with valuable insights and guidance every step of the way.

Broadneck Peninsula Real Estate Market: Weekly Insights and Trends

Hey there, Broadneck Peninsula! It’s time for your weekly real estate update. In the ever-evolving world of real estate, staying informed is crucial, especially if you’re considering buying or selling a home in our beautiful community. In the past seven days, we’ve seen some interesting developments in the local housing market. Let’s dive into the numbers and explore what’s been happening right here on the Broadneck Peninsula.

New Listings Surge:

Over the past week, the Broadneck Peninsula has experienced a surge in new home listings. A total of 27 new homes have hit the market, a noteworthy increase compared to the previous weeks. This influx of listings comes as a surprise, especially considering that the market typically experiences a softening as September approaches.

Speedy Sales:

In the current market, homes that are priced appropriately and staged effectively continue to sell quickly. Out of the 10 homes that have gone pending in the past week, the average time spent on the market was just 6 days. This indicates that well-prepared homes are in high demand, and buyers are ready to act swiftly when they find the right property.

Strong Demand:

Broadneck Peninsula continues to attract buyers with its charm and appeal. Of the 11 homes that closed in the last week, the average closed price was an impressive 4% over the list price. This suggests that the demand for homes in our community remains robust, and sellers are benefiting from competitive offers.

Seller Concessions and Home Inspections:

A notable trend in recent closings is the presence of seller concessions. In 5 out of the 11 closed listings, sellers provided concessions to buyers at closing. This trend indicates that home inspections are making a comeback in the real estate process. However, getting a home inspection accepted over competing offers still requires a well-thought-out strategy and creative approaches.

Navigating the Changing Market:

As you can see, the Broadneck Peninsula real estate market is dynamic and can change rapidly from week to week. To succeed in this market, it’s essential to stay informed, understand the nuances, and work with a knowledgeable real estate professional who can guide you through the process.

Conclusion:

In conclusion, the Broadneck Peninsula real estate market continues to be an exciting and dynamic environment for buyers and sellers. With new listings on the rise, speedy sales for well-prepared homes, and strong demand, it’s an excellent time to explore your real estate options in our beautiful community. If you have any questions or need assistance navigating this ever-changing market, don’t hesitate to reach out—I’m here to help you make the most of your real estate journey on the Broadneck Peninsula.

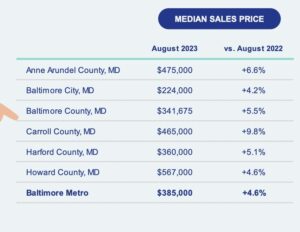

Unlocking the Truth: Anne Arundel County’s Hidden Gem of Affordability

Debunking the Myth: Anne Arundel County’s True Affordability in Annapolis Real Estate

When it comes to the Maryland real estate market, there’s a common misconception that Anne Arundel County is one of the least affordable places to call home. However, let’s set the record straight. In this blog post, we’ll delve into the reality of home prices and affordability in different Maryland counties, with a particular focus on Anne Arundel County Affordability. As of August 2023, we’ll explore the median sale prices in the Baltimore Metro area and discuss how property tax rates play a pivotal role in determining your monthly payments and overall affordability. So, if you’re considering purchasing a home in Anne Arundel County or neighboring areas, keep reading to gain a deeper understanding of the housing market dynamics.

The Misconception:

Anne Arundel County, often overshadowed by neighboring counties, has been unfairly labeled as one of the least affordable places to live. This notion has led many potential homebuyers to overlook the county as an option for their next home. However, the truth is more nuanced than this stereotype suggests.

The Data Behind the Myth:

Let’s turn our attention to the data. In August 2023, a graph of median sale prices in the Baltimore Metro area tells a different story. Contrary to popular belief, Anne Arundel County doesn’t top the list for the highest median sale price. Instead, it’s Howard County that takes the lead, with median prices significantly higher. Anne Arundel County finds itself in close competition with Carroll County, demonstrating that affordability in Anne Arundel is on par with its neighbors.

The Missing Piece: Property Taxes

While median sale prices are one piece of the puzzle, the often-overlooked factor in the affordability equation is property taxes. Anne Arundel County stands out in this regard, boasting the lowest property tax rates among these three counties. Carroll County’s rates are slightly higher, and Howard County’s rates are the highest.

Unpacking the Impact:

Now, let’s discuss why property tax rates matter. When combined with different median sale prices, property taxes can significantly influence your monthly mortgage payment and overall affordability. The lower property tax rates in Anne Arundel County can help offset the impact of a slightly higher median sale price when compared to Carroll County.

The Solution: Informed Decision-Making

So, how can you navigate this complex landscape when you’re considering a home purchase in the Baltimore Metro area? The answer lies in informed decision-making. As a prospective homebuyer, it’s crucial to work closely with your lender and real estate agent. They can help you run the numbers, considering both median sale prices and property tax rates, to ensure you stay within your comfortable monthly mortgage budget, regardless of the county you’re exploring.

What’s Next?

In the world of Annapolis real estate, misconceptions about Anne Arundel County’s affordability persist. However, by digging into the data and considering factors like property tax rates, you can uncover the truth. Anne Arundel County offers competitive affordability, especially when you factor in its favorable property tax rates. So, if you’re on the hunt for your dream home in the Baltimore Metro area, don’t let myths cloud your judgment. Work with professionals who can help you make a well-informed decision and find the perfect place to call home, whether it’s in Anne Arundel County, Carroll County, or Howard County.

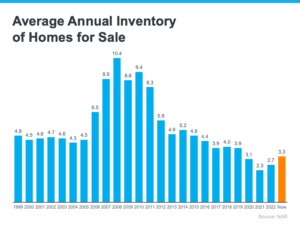

Navigating the Annapolis Real Estate Market: Understanding the Inventory Shortage

The Annapolis real estate market has been bustling with activity in recent years, but there’s one persistent challenge that has been on the minds of both buyers and sellers: the shortage of available inventory. In this blog post, we’ll delve into the reasons behind this shortage, and why it’s important to strategize in this competitive market.

Understanding the Inventory Shortage: A Historical Perspective

To comprehend the current inventory shortage in Annapolis, we must first acknowledge that this problem didn’t just emerge overnight. In fact, it has been a concern for years, with the situation deteriorating steadily over time. Even before the onset of the COVID-19 pandemic, the housing inventory had been declining. A telling graph illustrates this decline, which began during the aftermath of the housing crisis.

Why is There a Shortage of Inventory in Annapolis?

Several key factors have contributed to the persistent shortage of housing inventory in the Annapolis real estate market.

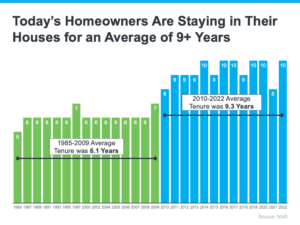

- Extended Homeownership: One significant factor is that homeowners are staying in their homes for more extended periods. In the years between 1985 and 2009, the average homeowner stayed in their property for approximately 6 years. However, from 2010 to 2022, this average increased significantly to 9 years. Longer homeowner tenures mean fewer homes available for sale in the market.

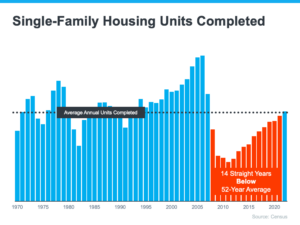

- New Construction Challenges: The new construction of single-family homes has faced a significant challenge in Annapolis. For 14 consecutive years, construction has fallen below the 52-year average. This trend can be traced back to the housing market crash, during which builders overbuilt and subsequently scaled back their construction activities. This reduced supply exacerbates the inventory problem.

- Low Mortgage Rates: Another recent issue that impacts inventory is the low mortgage rates. Currently, approximately 83% of home mortgages in Annapolis are at or below 5%. Homeowners with such favorable mortgage rates are less inclined to sell their homes until rates reach 5% or higher. This further restricts the availability of homes for sale.

What Does This All Mean for Annapolis Homebuyers and Sellers?

The persistent inventory shortage in the Annapolis real estate market doesn’t have a quick fix. Even when interest rates drop, homeowners with low mortgage rates may put their homes on the market, but many of them become buyers themselves, adding to the overall demand. So, if you’re patiently waiting for more inventory to become available or hoping for prices to drop, it’s essential to take proactive steps.

Taking Action: Let’s Strategize Together

In this challenging market, it’s crucial to have a well-thought-out strategy. If you’re a buyer or seller in Annapolis, waiting for the right moment, consider reaching out tome. We can work together to create a tailored strategy that aligns with your goals and helps you navigate the current real estate landscape effectively.

The Annapolis real estate market’s inventory shortage is a complex issue driven by long-standing problems and recent trends. While it may not have a quick resolution, proactive strategies can help buyers and sellers achieve their objectives in this competitive environment. Don’t hesitate to get in touch with us to discuss your real estate goals and chart a path forward in the Annapolis market.

Mortgage Calculator: Understanding the Pitfalls

When it comes to estimating affordability and monthly mortgage payments, many potential homebuyers in today’s real estate market turn to mortgage calculators. However, relying solely on these online mortgage calculators can be misleading and fail to provide a comprehensive understanding of your financial situation. In this blog post, we will explore the pitfalls of relying on mortgage calculators and emphasize the importance of consulting with a lender for accurate information tailored to your unique circumstances. Whether you’re looking to buy real estate in Annapolis, this article will guide you through the pitfalls and present alternative solutions to ensure a more precise assessment of your mortgage payments.

Mortgage Calculator Pitfall 1: Missing Crucial Elements

Taxes and Insurance Mortgage calculators often overlook two critical components of your mortgage: taxes and insurance. These expenses significantly impact your overall monthly payment but are frequently disregarded by generic online calculators. By omitting these factors, mortgage calculators provide incomplete and potentially misleading estimates of your affordability.

Mortgage Calculator Pitfall 2: Missing Crucial Elements Inaccurate Interest Rates

Mortgage calculators typically assume a fixed interest rate, which may not reflect the rate you’ll actually receive from a lender. Interest rates can vary based on factors such as your credit score, loan type, and market conditions. Relying solely on the default or estimated interest rate provided by a mortgage calculator can lead to inaccurate calculations of your monthly payments, potentially affecting your budget and financial planning.

Mortgage Calculator Pitfall 3: Missing Crucial Elements Ignoring Individual Financial Situations

Most mortgage calculators automatically input a 20% down payment, assuming it as the standard requirement. However, this may not be suitable or necessary for everyone. Each person’s financial situation is unique, and alternative down payment options are available that better align with your needs. By relying solely on a mortgage calculator, you may overlook the flexibility offered by various down payment programs, limiting your homebuying options.

Mortgage Calculator Pitfall 4: Missing Crucial Elements Unawareness of Alternative Affordability Programs

Another significant drawback of mortgage calculators is their failure to consider different programs designed to make homeownership more affordable and accessible. Numerous local and national initiatives offer down payment assistance, grants, or special loan programs to help homebuyers overcome financial obstacles. By not exploring these options, you might miss out on opportunities to purchase a home earlier or with better financial terms than originally anticipated.

Relying solely on mortgage calculators can result in inaccurate estimations of your affordability and monthly mortgage payments. To make well-informed decisions when buying real estate in Annapolis, it is crucial to consult with a trusted, local lender who can provide personalized advice based on your unique financial situation. Don’t let the limitations of mortgage calculators hold you back! Click the link, Connect with a lender for my trusted local lender who can guide you through the mortgage process

The Annapolis Real Estate Market Frenzy— It’s Back and Here’s Your Time to Cash In

Are you a homeowner in Annapolis, Maryland, who missed out on the last real estate market frenzy? You might be feeling like you lost your chance to sell your home for top dollar. But the good news is that the real estate market has flipped a switch once again, and it’s a fire hot seller’s market in Annapolis, Maryland.

If you’re thinking of selling your in Annapolis, Maryland now is the time to act. But here’s the thing, buyers are pickier this go around, so we need to get your home ready for the market to maximize your profits. Here are some tips to help you sell your home quickly and for the best price:

Get your home on the market now: Spring is traditionally the best time to sell a home, but with more competition, you might want to consider listing your home earlier. Take advantage of the current low inventory and get your home on the market as soon as possible.

Work with an experienced realtor: Selling a home can be a complex and stressful process, which is why it’s important to work with a realtor who has experience in the Annapolis, Maryland real estate market. They can help guide you on how to get your home market ready, stage your home, set the perfect price to encourage a bidding war, and take the stress away from you.

Make sure your home is in top shape: Buyers are pickier this time around, so you want to make sure your home is in the best possible condition. To get a great price and terms you need to make repairs and possibly small upgrades, paint and carpet go a long way. You should always declutter and depersonalize your home so the buyer can envision themselves there, and hiring a professional stager to make your home look its best.

Market your home like a pro: To make your home stands out from the competition, you need to market it like a pro. Use high-quality photos and video to highlight the many features of your home and get it seen by the most potential buyers.

As a realtor in Annapolis, Maryland, I have extensive experience in the local Annapolis real estate market and can help you sell your home quickly and for the best price. I understand the unique challenges of selling a home in Annapolis and can provide you with personalized advice and support throughout the process.

So if you’re thinking of selling your home in Annapolis, Maryland, don’t wait any longer. Take advantage of the current seller’s market, and let me help you get the best price for your home. Want to know what your home is worth, click here for a free market analysis!

For more real estate insight click here

Top 5 Buyer Myths Debunked

If you're thinking about buying a home in Annapolis, Maryland in 2023, you might be wondering how to get started. The home buying process can be daunting, especially if you're a first-time buyer. Unfortunately, there are several myths out there that can stop you from taking the first step towards building wealth through home ownership. In this post, we will debunk the top 5 buyer myths that might be stopping you from buying a home and building wealth.

Buyer Myth 1: Thinking You Need To Put 20% Down

While a larger down payment can help you avoid private mortgage insurance (PMI), it's not necessary to put 20% down. Depending on your financial situation and the type of loan you qualify for, you could put as little as 0% down if you're using a VA or USDA loan, 3.5% if you're using an FHA loan, or 3-5% for some conventional loans. The average down payment for first-time homebuyers in 2021 was only 7%, and for repeat buyers, it was 17%.

Buyer Myth 2: Thinking You Don't Have Enough Cash

Another common myth that stops buyers from taking the first step. However, keep in mind that sellers can and may pay for your closing costs. In fact, 42% of home sales in Q4 of 2022 resulted in sellers giving concessions to buyers. This is something that your real estate agent can discuss with you when writing and presenting an offer on a home. Don't let the fear of not having enough cash stop you from reaching out to a realtor to discuss your options.

Buyer Myth 3: Thinking Your Credit Isn't High Enough

Your credit score is a crucial factor in qualifying for a mortgage, but it's not the only factor. While a conventional loan generally requires a 620 credit score, you can qualify for an FHA loan with a 580 credit score. Even if your credit score is not where you want it to be, don't let that stop you from reaching out to a lender. They can help you develop a plan to improve your credit score and increase your chances of qualifying for a loan. They can also help you explore different loan options that might be a good fit for your financial situation.

Buyer Myth 4: Thinking The Interest Rate You Got From One Lender Is Your Only One

Many buyers make the mistake of thinking that the interest rate they got from one lender is the only rate they can get. However, it's always a good idea to shop around to find the best rate. You can also explore different ways to lower your interest rate, such as buying it down, asking the seller to buy it down, or exploring adjustable-rate mortgages.

Buyer Myth 5: Now is Not a Good Time to Buy

This is a myth that we hear all the time, especially when there's a lot of uncertainty in the real estate market. However, it's important to remember that real estate markets are local, and what might be true in one area might not be true in another. In January 2023, the Annapolis and surrounding area real estate market is stable, with fewer bidding wars and more opportunities for seller concessions. It's always a good idea to reach out to a real estate agent and ask them about the current market conditions in your area.

In conclusion, don't let these buyer myths stop you from taking the first step towards building wealth through home ownership. Reach out to a real estate agent to discuss your options!